SaaS companies rely on predictable revenues and scalable operations, but they need to have a firm grasp of what sorts of financial metrics — particularly gross margin — they should be reporting to stay on the right side of the long-term success equation.

By looking at gross margin and, ideally, tracking it over time, we can assess a SaaS company’s profitability, operational efficiency, and cost structure. These are all incredibly important, of course; but the gross margin is also a powerful factor for securing funding and partnerships.

As the competition in the SaaS industry heats up, a high gross margin is essential for maintaining a durable business model. Successfully managing expenses while scaling revenue isn’t easy, but companies that achieve this balance and master the gross margin gain a clear competitive edge. This article covers what you need to know about the SaaS gross margin, including how to calculate it, the key factors that influence it, and strategies for improving it over the long haul.

How to Calculate SaaS Gross Margin

SaaS gross margin is a key financial metric that measures the profitability of a SaaS business after accounting for the direct costs of delivering its service.

It shows how efficiently a business transforms its income into earnings while maintaining the needed infrastructure and support to operate smoothly.

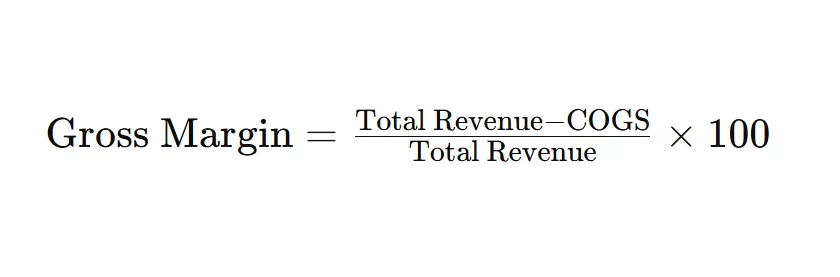

A strong gross margin means the costs are well-managed and makes the business more attractive to investors and stakeholders. Also, monitoring it over time will show trends in inefficiencies or opportunities for improvement. To formula to calculate it is:

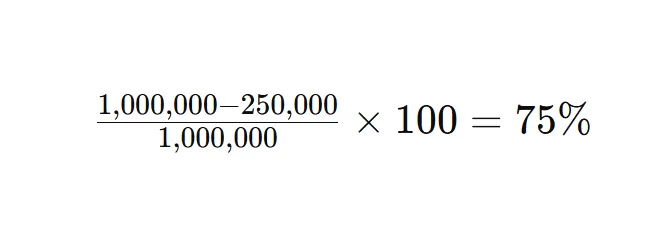

For example, if a SaaS company generates $1,000,000 in revenue and it has $250,000 in Cost of Goods Sold (COGS), the calculation would be:

This means that 75% of the company’s revenue remains after covering the direct costs associated with service delivery.

What is Included in SaaS COGS?

The COGS for a SaaS company encompasses all direct expenses tied to the delivery and maintenance of the software service. Even though the precise elements may differ from business to business based on the accounting practices and business strategy, the typical line items found in COGS are:

Hosting and Infrastructure Costs

- Cloud computing services (AWS, Google Cloud, Azure)

- Data storage and bandwidth expenses

- Server maintenance and monitoring

Software Licensing and Third-Party Tools

- APIs and third-party software integrations

- Payment gateway fees

- Security and compliance tools

Customer Support and Technical Operations

- Salaries and benefits of customer support teams

- DevOps and site reliability engineering costs

- 24/7 system monitoring and incident response

Customer Success Teams

Whether or not customer success (CS) costs are included in COGS depends purely on your business model. If your Customer Success team is dealing only with retention or customer training and support, then the cost should sit in the cost of goods sold. They are focused on product adoption.

However, suppose your Customer Success is focused on business transactions such as upselling, cross-selling, and holds a quota. In that case, those costs should be placed under sales and marketing operating expenses (OpEx).

If they have both functions, then the costs should be split accordingly between COGS and OpEx.

Why SaaS Gross Margin Matters

Profitability and Business Sustainability

Besides other SaaS KPIs, gross margin is an essential indicator of financial health. It demonstrates how much revenue remains after paying the direct costs of delivering a service.

A high gross margin guarantees that a SaaS company has enough money left over to cover its ongoing operational expenses and, more importantly, to invest in the kind of continuous innovation that ensures long-term survival in the fast-paced world of software.

Scalability and Growth Potential

A high gross margin indicates that a SaaS business can scale efficiently without increasing the cost per acquisition.

You need to remember that SaaS businesses have a substantial cost upfront with development expenses. After that, the cost of adding a new user is marginal. And this is what allows them to scale profitably and grow.

Investor Appeal and Valuation

When assessing SaaS firms, investors pay very careful attention to the gross margin. A strong gross margin signals a business model that’s not just healthy but also appealing—one that combines pricing power with cost efficiency.

Even as the SaaS industry matures, and some might argue we’re entering a “down round” phase, gross margin can be the thing that makes a company more attractive to investors and funders, because it can be a signal (or a semi-signal) that a company has a business that’s going to be around for a while.

Competitive Advantage and Benchmarking

SaaS firms can gauge their performance against industry benchmarks and competitors by monitoring gross margins. And why is that?

Because the gross margin tells a company how much of its revenue, after costs of goods sold, is left to cover operating expenses. In other words, it’s the first look at a company’s profitability, without the heavy accounting that comes into play when “net income” is served up.

Resource Allocation and Strategic Planning

The gross margin holds a key position in helping make decisions on how to allocate resources. A falling gross margin may warn of inefficiencies, rising costs in delivering service, or problems with pricing that could justify making some sort of adjustment.

Gross margin provides key signals that companies can use to help make a number of important decisions that impact overall profitability.

Pricing Strategy Optimization

Studying the gross margin lets SaaS companies refine their pricing strategies. High-margin companies have more flexibility to invest in premium features, customer support, or competitive pricing models.

Companies with lower gross margins may need to reassess their pricing structure to stay profitable while trying to remain competitive.

SaaS Gross Margin Benchmarks

SaaS has different gross margin levels depending on the business model, operational efficiency, and target market. It is important to understand these levels and the reasons behind them to accurately assess a company’s financial health and to identify areas for meaningful improvement and change.

High-Performing SaaS (Enterprise, Cloud-Heavy): 80-90%

These companies usually take advantage of economies of scale and have cloud infrastructures that are completely optimized, which leads to margin expansion.

Typical SaaS Companies: 70-80%

Most SaaS companies are in this space, striking a balance between having the pricing power to grow while maintaining an efficient cost structure.

Infrastructure & Low-Margin SaaS (e.g., API-heavy, security): 50-70%

Companies that rely on significant backend processing or hefty data transfer expenses usually have slim margins.

SaaS with High COGS (e.g., fintech, video streaming, hardware-integrated SaaS): 40-60%

Companies operating in these industries frequently confront high charges for payment processing, compliance costs that are through the roof, and pricey content licenses—all of which detract from their bottom line.

Knowing where your company sits within these ranges can help you set realistic financial targets and make better strategic decisions to optimize profitability.

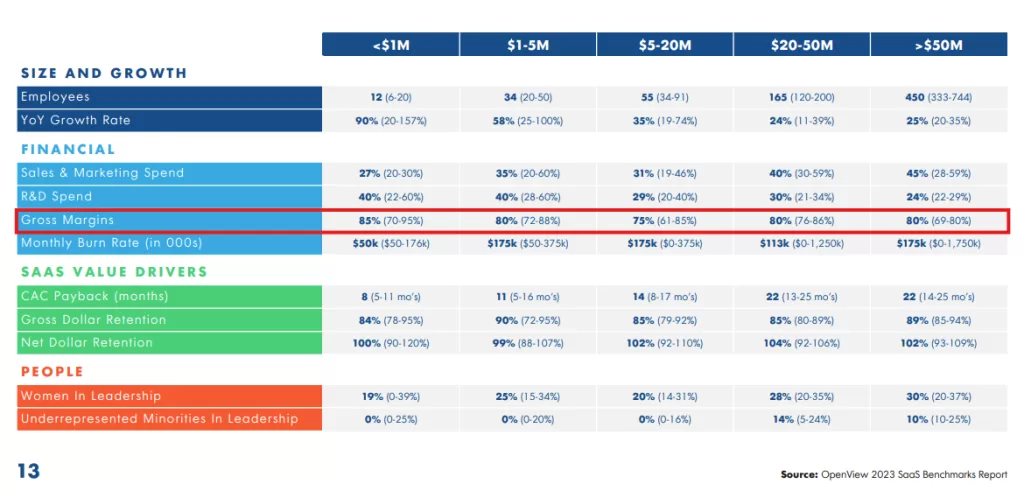

Here’s a 2023 SaaS report on the median Financial and Operating metrics for 2023 from OpenView.

How to Improve SaaS Gross Margin

Optimize Cloud and Hosting Costs: Right-sizing infrastructure and negotiating better terms with cloud service providers can profoundly reduce hosting costs. Companies should keep a close eye on their cloud consumption, prune needless services, and take advantage of volume discounts.

Automate part of your Customer Support: Try out AI-powered chatbots or self-service portals. By improving automation, you can have the most common/basic questions covered, while having your Support specialists help clients with more difficult or edge cases.

Improve Pricing Strategy: Adjust and anchor price tiers to the value provided without significantly increasing COGS. Try offering premium pricing plans, bundling features, or implementing value-based pricing strategies to see if you can increase revenues while maintaining a sustainable cost structure.

Enhance Customer Retention: Reducing churn is a cost-effective way of increasing SaaS gross margins. And focusing on customer success initiatives can increase the customer lifetime value (CLTV). One way to try this without massively increasing your headcount is by trying with a couple of digital customer success positions.

Reevaluate COGS Allocation: Only direct costs should be included in COGS. Including indirect costs or even some direct costs that aren’t truly the cost of goods sold can inflate costs and deflate profitability.

Optimize Third-Party Software and Vendor Costs: Evaluate and renegotiate agreements with third-party vendors, APIs, and software providers to manage costs. Consolidating tools or migrating to more economical options can also enhance the gross margin.

Conclusion

For SaaS businesses, having a solid gross margin is essential for long-term financial health, scalability, and investor confidence. A gross margin of at least 70% sets a company on the right path.

As the SaaS sector keeps changing, businesses that actively control their gross profits will be better placed for long-lasting success. They will do this through saving initiatives, using automation to better their business, and finding improved pricing models. These actions can create a business that is not just resilient but also one that has a strong financial footing.

And what’s really good is that these actions also lead to better long-term customer satisfaction and a stronger leadership position in the market.