Scaling a SaaS business is a fine balancing act between growth and profitability. And the CAC payback period is one of the metrics that will tell you if there are any problems with the growth strategy.

Many companies invest heavily in acquiring new customers but have a hard time making their income streams profitable. The real challenge is not just attracting new customers but rather ensuring that the revenue from those customers pays back the acquisition cost within a reasonable time frame.

What is Customer Acquisition Cost (CAC)?

Before going into CAC Payback Period, it is necessary to define Customer Acquisition Cost (CAC). This cost measures the total expenses related to sales and marketing efforts that are necessary to secure a new customer. The way to calculate it is:

CAC = Total Sales and Marketing Expenses/Number of New Customers Gained

The cost includes: ad spend, content marketing costs, sales team compensation (including commissions), marketing software, and customer onboarding. If the CAC is too high compared to the amount of money a customer brings in, SaaS companies may struggle to achieve profitability.

Tracking CAC accurately enables companies to know if their marketing and sales efforts are sufficiently cost-effective or if they need to recalibrate to achieve better financial efficiency.

Defining CAC Payback Period

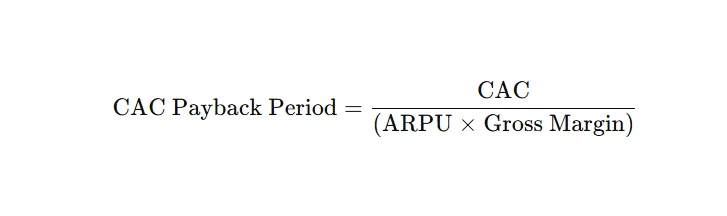

While CAC tells us how much it costs to get a new customer, the CAC payback period determines how long it will take to recoup that investment through the revenue generated from that customer. The formula is:

Where:

- ARPU (Average Revenue Per User) = The average revenue per customer per month

- Gross Margin = (Revenue – Cost of Goods Sold) / Revenue

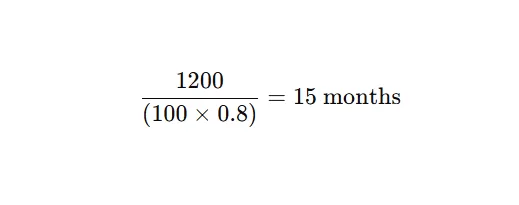

For example, if a company’s CAC is $1200, its ARPU is $100/month and its Gross Margin is 80%, the CAC payback period would be:

This means it would take the business 15 months before making a profit from a customer.

A shorter CAC Payback Period helps with reinvesting faster into marketing and customer acquisition, reducing the reliance on external funding. On the other hand, a longer payback time might put pressure on the business and create cash flow issues, making it difficult to scale.

Why CAC Payback Period Is Crucial for SaaS Businesses

The rate at which SaaS companies recoup customer acquisition costs has a direct impact on cash flow and profitability. Here’s why it matters:

Capital Efficiency & Cash Flow

Acquiring customers costs a lot of money for SaaS companies. When the payback period for customer acquisition cost is shorter, that means the company can reinvest in growth sooner without raising too much additional capital.

Growth & Scalability

When the payback period of a SaaS company’s customer acquisition cost is high (for example, 24 months or more), that company needs growth capital in the form of a large cash reserve or venture capital funding to sustain its growth. A lower payback period of the customer acquisition cost allows a SaaS company to scale faster without excessive cash burn.

Investor and Stakeholder Confidence

Investor scrutiny of CAC payback is intense because it signifies business sustainability. A SaaS company with a 6-12 month CAC payback is usually more appealing to investors than one with a 24-month payback.

Marketing & Sales Efficiency

Inefficiencies in marketing or sales can lead to a long payback period for customer acquisition costs (CAC). Optimizing ad spend, increasing conversion rates, and improving upselling strategies reduce payback time.

What Is a Good CAC Payback Period?

Broadly speaking, the faster you get to recoup your investment, the better. David Skok, after looking at a wide variety of SaaS startups stated that a good guideline is to aim for a CAC payback period of under 12 months.

But do keep in mind that there are a lot of variables that influence the CAC payback period including the size of the company, the funding, and the market conditions.

A big caveat with benchmarks is that a CAC payback period that is good for one business might be bad for another one. You need to take into account factors such as customer lifetime, how much cash and runway you have, the potential for price increases in the future, and the stage of the market you’re in.

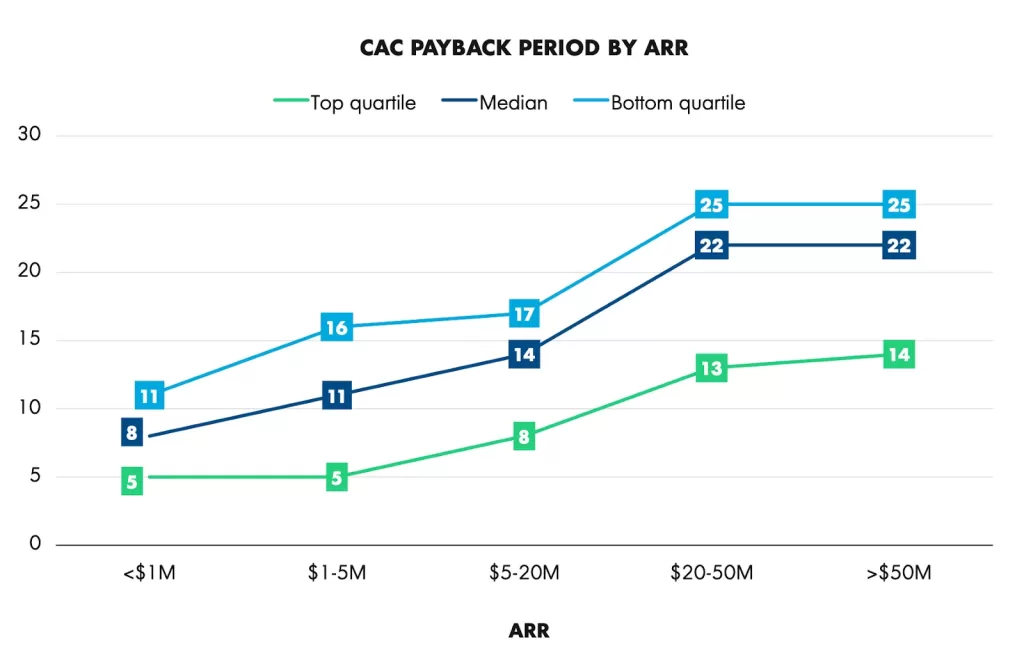

However, it is still useful to look at some benchmarks to assess your company’s performance. But make sure to look at companies with similar characteristics.

Looking at the 2023 data from OpenView, as companies grow, so do their customer acquisition costs leading to a higher payback period. However, it all depends on their Net Dollar Retention (NDR). With higher NDR, companies can withstand longer payback periods.

How to Reduce Your CAC Payback Period

Lowering your CAC payback period is vital for better cash flow, increased profitability, and sustainable growth. Software as a service businesses can accomplish this by emphasizing two basic types of strategies: expanding revenues and reducing costs.

Improve Customer Onboarding and Activation

Delays in onboarding can push back revenue generation, extending the CAC payback period. With good onboarding flows, customers can experience the impact faster which will also increase retention in the future. To speed up activation, you can offer self-serve onboardings, in-app tutorials, and great customer support resources.

Increase Pricing or Optimize Revenue per Customer

Raising prices or adjusting your pricing model can significantly impact your payback time. If customers generate more revenue per month, you can recover the acquisition costs faster. So, try experimenting with tiered pricing, annual contracts, or add-ons. These can also help increase your revenue per customer without necessarily increasing prices.

Improve Marketing Efficiency

Inefficient marketing campaigns can increase CAC and extend the time it takes to regain the cost of newly acquired customers. To improve the efficiency, you should focus on the high-converting channels, and slowly shift towards organic growth channels (SEO, content marketing, and referrals). You can also use metrics like the marketing efficiency ratio (MER) to track your overall marketing results.

Reduce Sales Cycle Length

A long sales cycle not only delays revenue generation but also increases your CAC. Here, you can look at implementing automation in the lead qualification process or optimizing your demo-to-close rates to speed up the conversion.

Increase Customer Retention and Upsells

Subscription customers become significantly more profitable over time. Retention strategies that work—like offering excellent customer support, personalized engagement, or building a strong community around the product—can improve LTV and reduce the effective CAC payback period. Stronger revenue-per-customer strategies like upselling and cross-selling can also create a scenario in which you can recoup CAC quicker and with fewer customers needing to churn.

Conclusion

The CAC payback period is a critical metric that impacts your profitability, investor confidence and sustainable growth. The sooner you can recover your acquisition costs, the sooner you can reinvest it in scaling your business.

SaaS companies can trim the CAC Payback and boost cash flow by refining their pricing models, optimizing their marketing channels, and retaining more of the customers they have won.